As of December 2025, Australia’s housing market continues to show firm momentum, supported by lower interest rates, stronger borrowing power, rising investor activity, and tight housing supply. Buyer confidence has noticeably improved, though affordability constraints may start moderating growth as we head into 2026.

Major Regulatory Update: APRA Introduces Debt-to-Income Caps (Effective Feb 2026)

APRA has confirmed new lending rules that will cap the share of high debt-to-income (DTI) loans banks can issue. From February 2026, no more than 20% of new mortgages can exceed a DTI of 6× income.

What this means for borrowers

- Most buyers won’t feel an immediate impact — banks are already well below the cap.

- However, investors and borrowers relying on high leverage may face tighter credit assessments, reduced borrowing capacity and slower approval timelines.

If you’re planning to purchase or refinance in early 2026, now is an ideal time to review your borrowing position.

Strategic Takeaways

- For investors: Strong fundamentals—stable income, conservative leverage, and disciplined LVRs—become even more important to securing finance.

- For high-leverage borrowers: Consider locking in loans or reviewing strategy before the rule comes into force.

- For the market: This functions as a “stability guardrail,” moderating risky lending without restricting broader credit availability. It may cool speculative activity but isn’t expected to slow overall demand significantly.

Market Indicators at a Glance

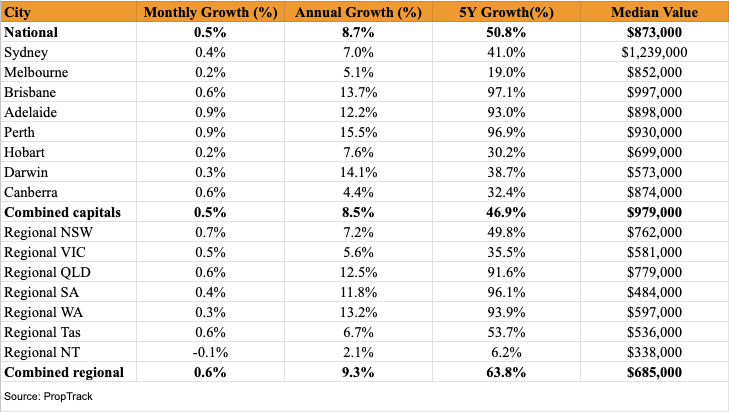

Home Prices

- National home values +0.5% in November, reaching a new record high.

- Prices now +8.7% higher year-on-year, adding ~$77,900 to the median home value.

- Median national price now $873,000.

Interest Rates

- Rates remain on hold, with previous cuts still supporting confidence.

- No further decreases expected in the near term.

Refinancing Activity

- Refinancing remains elevated as borrowers reposition portfolios amid stable interest rates and competitive lender offerings.

Capital Cities vs Regionals

- Capital cities: +0.5% (monthly), +8.5% (annual)

- Regionals: +0.6% (monthly), +9.3% (annual)

- Five-year gains: Regionals +63.8% vs Capitals +46.9%

Auction Activity

- 3,488 auctions across combined capitals — up 17.7%, marking a seasonal peak.

- Clearance rate: 68.2%, slightly below decade and spring averages as supply rises.

.png?alt=media&token=edbf3bb6-c02c-4cc5-90fd-9008ee1433b2)

InvestorPro Observations

Our on-ground research and day-to-day activity across key investment markets highlight several important shifts:

- Competition for quality stock remains intense, especially in the $600k–$900k range. Buyers are acting quickly as limited listings and stabilised interest rates boost confidence.

- Time-on-market continues to shrink in growth capitals such as Brisbane, Adelaide and Perth. Well-located, investor-grade properties are attracting multiple offers and often selling above expectations.

- First-home buyer activity is reshaping entry-level markets, driving renewed demand in affordable suburbs and pushing spill-over growth into nearby middle-ring areas.

- Investor lending behaviour is already adjusting ahead of APRA’s new DTI rules. More investors are reviewing borrowing power and restructuring finance early to secure opportunities before conditions tighten in 2026.

Recommended Actions for Investors

To stay competitive in the current environment, we recommend:

- Get your finance in order early. With APRA’s lending caps coming into effect in 2026, securing pre-approval and understanding borrowing capacity is essential—especially for investors relying on leverage.

- Act decisively when the right asset appears. Tight stock levels and strong buyer demand mean quality properties move quickly and often attract multiple offers.

- Focus on fundamentals. Target markets with strong rental demand, low vacancy rates, infrastructure growth and constrained supply to maximise long-term performance.

- Prepare to make competitive, data-backed offers. Prices continue to test new highs, so having realistic and informed bidding strategies is crucial to securing investment-grade opportunities.

Want to stay ahead of the market ?

and let us tailor an investment strategy to fast-track your journey.