If you’ve been saving and dreaming of your first home but still feeling stuck, the changes taking effect on 1 October 2025 could be a game changer. The expanded Home Guarantee Scheme is set to make entering the property market easier for many Australians. As a buyer’s agent, I see how these updates can reshape buying opportunities — and why knowing the details for your city or region will help you plan smartly and act strategically.

The Game-Changing Reforms

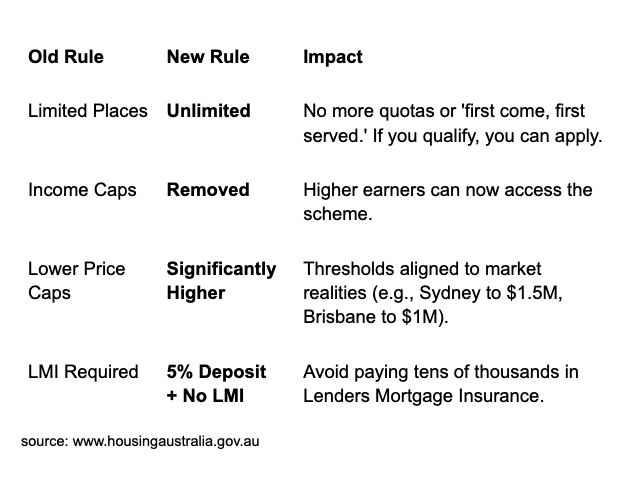

The restrictions that previously locked many buyers out are gone. Here is a comparison of the new rules to the old ones.

A Critical Watchpoint: Will Prices Rise Everywhere?

This is the question I get asked most often, and it's a valid concern. The short answer is: Probably not everywhere, but almost certainly in the markets the scheme targets.

The expansion of the Home Guarantee Scheme is a classic example of demand-side stimulus. By making it easier for a larger pool of buyers (unlimited places, no income caps) to secure a loan with a small deposit, the government is effectively injecting new demand into the market.

The Expert Consensus

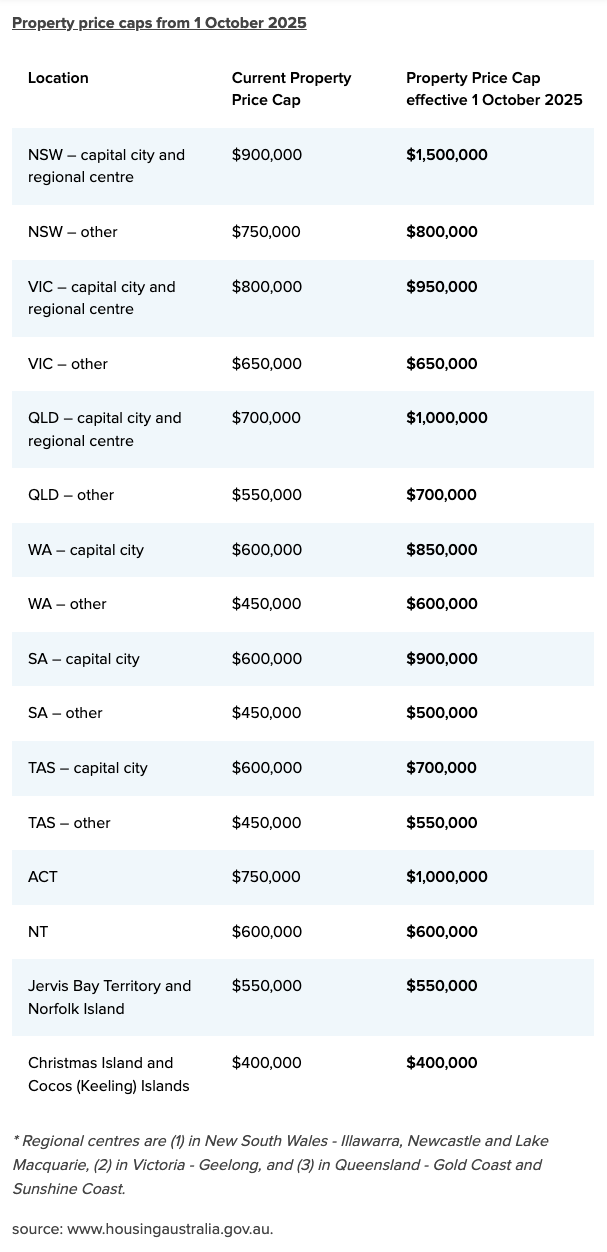

- Key Risk Areas: Analysts widely anticipate a short-term price boost in the specific price brackets near or under the new caps. For instance, strong competition is likely for properties between $900K and $1.5M in Sydney, $800K and $950K in Melbourne, and $700K and $1M in Brisbane.

- Supply Constraint: Since the policy does not address Australia's fundamental shortage of housing supply, injecting a large new pool of eligible buyers into the market will inevitably intensify competition and drive up prices in these key entry-level segments.

- Market Reality: While official modelling suggests a modest national impact, real-world market reports already show increased buyer frenzy and price bumps in target areas before the scheme even starts. The effect will not be universal, but the ripple of increased demand will be felt across the middle and entry-level markets.

The scheme is a significant tool for solving the deposit hurdle, allowing you to get in sooner and save tens of thousands on LMI. But it does not solve the supply problem. You must factor in the high likelihood of increased competition in the entry-level market and be prepared to act decisively and strategically to avoid overpaying.

How This Plays Out in Different Markets

- Sydney / NSW: More suburbs now fall within reach under the $1.5M cap — particularly fringe and middle-ring areas, and importantly, the cap is extended to major regional centres like Newcastle and Illawarra.

- Melbourne / VIC: The $950K cap eases pressure, though inner suburbs may remain tight. Regional Victoria (including Geelong) sees more opportunity.

- Brisbane / QLD: A big step up to $1M opens options across both city and major regional centres (Gold Coast, Sunshine Coast).

- Perth, Adelaide, Hobart: Higher caps make near-city and suburban homes significantly more accessible for first home buyers.

Property price caps from 1 October 2025, across all Capitals and Regionals

What Does This Mean for the Property Investor?

For property investors, the Home Guarantee Scheme (HGS) expansion represents both a market risk and a strategic opportunity.

The most direct impact is Increased Competition in the Entry-Level Market. The investor pool now faces steeper competition from government-backed First Home Buyers (FHBs), who target the same entry-level properties (apartments, townhouses) often sought for high rental yield. The influx of new, highly-leveraged buyers will likely lead to price escalation in the specific price bands aligning with the new caps (e.g., up to $1.5M in Sydney).

Investor Strategy: Adjusting to the New Normal

To counter the short-term competition, strategic investors should:

- Go Above the Cap: Target properties just above the new FHB caps (e.g., $1.6M in Sydney) for a more rational buying environment.

- Focus on Fundamentals: Prioritise core investment metrics like population growth, infrastructure, and strong rental yields over FHB "hotspots."

- Consider Niche: Look for established assets with land content, as they offer more reliable long-term capital growth

The Crux of the Decision: Owner-Occupier vs. Investor

The crucial decision of whether to "worry" about price increases under the expanded Home Guarantee Scheme (HGS) boils down entirely to your motive and timeline.

For the First Home Buyer (Owner-Occupier), whose primary goal is lifestyle and security, the answer is a cautious YES—you must be alert. Higher competition in the key price brackets means you risk rushing the decision or overpaying in an auction frenzy. Your strategic imperative is to stick rigidly to your budget (based on serviceability, not the maximum cap), act quickly to secure pre-approval, but never panic-buy or bid beyond a sensible valuation, as your goal is stable homeownership now.

Conversely, for the investor, whose primary goal is financial and portfolio growth, the answer is NO in the traditional sense. The price pressure is viewed as a market condition creating new opportunities. Their strategic imperative is to stick to long-term investment goals, leverage the increased FHB demand as a sign of market liquidity, and focus on acquiring assets that deliver superior long-term returns, even if it means paying a slight, strategic premium now in anticipation of future capital growth.

Opportunities vs Risks

Opportunities

- Buy sooner with less saving time.

- Access more suburbs and property types.

- Overcome the “saving forever” hurdle.

Risks & Watchpoints

- More eligible buyers = more competition, which could drive prices higher.

- Standard lending checks still apply (serviceability, credit, etc.).

- Other costs remain: stamp duty, legal fees, ongoing maintenance.

How to Make the Most of It

- Check the new caps for your preferred suburb or postcode using the table above.

- Engage a mortgage broker early to confirm your borrowing power and secure pre-approval.

- Budget for total costs, not just deposit + purchase price.

- Decide your timing carefully - sometimes acting right after changes kick in provides a window before sellers fully adjust expectations.

- Watch supply levels - new builds or regional growth areas may offer value plays.

Summary

The expanded Home Guarantee Scheme has fundamentally changed the competitive landscape. For the savvy investor, this requires a refined strategy that goes beyond simple market averages. Ensure that the Property you purchase aligns with your individual needs to achieve maximum returns while navigating the competitive market created by the new FHB policy.

Ready to move before the market heats up?

and let us tailor an investment strategy to fast-track your journey.